Wednesday, February 22, 2006

Continue to hold Telstra and buy Argo

Trustees will further investigate Argo Investments with view to buy a stake to allow participation in share purchase scheme.

Saturday, February 18, 2006

Investment in Argo Investment

Low Management Costs

No management fees are charged by Argo and being a listed company, only normal stockbroker charges apply when shares are purchased and sold. For the year ended 30 June, 2005 total operating costs were 0.15% of total assets at market value.

Franked Dividends

Argo pays dividends in March and September each year. Imputation credits on dividends received by Argo are passed on through the fully franked dividends paid to Argo shareholders, with all shareholders benefiting from the associated tax credits. Certain Australian share holders can also claim a tax benefit where the dividend is sourced from a LIC capital gain.

Share Purchase Plan

Argo has a Share Purchase Plan which enables shareholders to invest up to $5,000 a year in additional shares, currently at a 2.5% discount off the market price. Participation in the SPP is entirely at the option of the shareholders and no transactional costs apply.

Dividend Reinvestment Plan

Argo has a Dividend Reinvestment Plan, which is currently offered to eligible shareholders at a 2.5% discount off the market price. Participation in the DRP is again entirely optional and no transactional costs will apply.

Share Issues

Argo also has a history of making attractively priced new issues of shares to our existing shareholders.

Combined with their outperformance of All Ords Accumulation INdex for 5,10,15 and 20 years.

Initial investment of between $2-$5k will be made and then a regular investment of $400-$800 per month to dollar cost average in to the stock.

Wednesday, February 08, 2006

BHP position not taken

Thursday, February 02, 2006

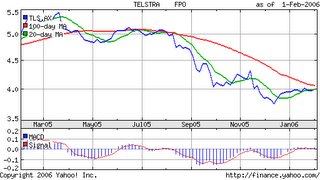

Holding Telstra

At any rate the dividend has been better than interest and as stated the trustees believe they will get to sell above the average price, some time in the future. They will look at call options on Telstra.