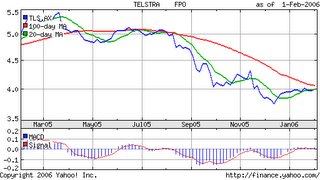

The Trust will continue to hold Telstra. The latest pop in share price on news of T3 in encouraging that the trustees original investment thesis will be fulfilled. The trust will be able to sell some of it's holding over the average paid and will have netted the attractive dividends for that period. Despite being in the troubled Telecommunications industry the trustees had believed if as the largest shareholder the government had known any information that would have led them to believe $5.25 for not a realistic price for T3 then they would have stated that and lowered their price accordingly. However, despite having the knowledge they did not lower their price target. This resulted in the Trusts purchase of a volume and portfolio percentage of the shares far greater than they would normally allocate to an individual share. The other contributing factor was the announcement of the special dividend combining to form $.40 a year in franked dividend. Was that a bribe to unload shares by the company?

At any rate the dividend has been better than interest and as stated the trustees believe they will get to sell above the average price, some time in the future. They will look at call options on Telstra.

No comments:

Post a Comment